Choosing Between Annual Leave and Vacation and Sick Leave

Frequently Asked Questions About Nonindustrial Disability Insurance (NDI)

What is NDI?

NDI is a wage continuation program. It is a fringe benefit completely paid for by the state. There are no employee contributions, enrollment fees or medical examinations required in order to be covered.

What Your Union Contract Says on NDI

A. Non-Industrial Disability Insurance (NDI) is a program for State employees who become disabled due to non-work-related disabilities as defined by Section 2626 of the Unemployment Insurance Code.

B. For periods of disability commencing on or after October 1, 1984, eligible employees shall receive NDI payments at 60% of their full pay, not to exceed $135 per week, payable monthly for a period not exceeding 26 weeks for any one disability benefit period. An employee is not eligible for a second disability benefit due to the same or related cause or condition unless they have returned to their regular time base, and work for at least ten (10) consecutive work days. Paid leave shall not be used to cover the ten (10) work days.

C. The employee shall serve a ten (10) consecutive calendar day waiting period before NDI payments commence for each disability. Accrued vacation or sick leave balances may be used to cover this waiting period. The waiting period may be waived commencing with the first full day of confinement in a hospital or nursing home for at least one full day. A full day is defined as a 24-hour period starting at midnight.

D. If the employee elects to use vacation, annual leave, personal leave or sick leave credits prior to receiving NDI payments, he or she is not required to exhaust the accrued leave balance.

E. Following the start of NDI payments, an employee may, at any time, switch from NDI to sick leave, vacation leave, annual leave, personal leave, or catastrophic leave but may not return to NDI until that leave is exhausted.

F. In accordance with the State’s “return to work” policy, an employee who is eligible to receive NDI benefits and who is medically certified as unable to return to full-time work during the period of his or her disability, may upon the discretion of his or her appointing power work those hours (in hour

increments) which, when combined with the NDI benefit, will not exceed 100% of their regular “full pay.” This does not qualify the employee for a new disability period under subsection (B) of this section. The appointing power may require an employee to submit to a medical examination by a physician or physicians designated by the Director of the Employment Development Department for the purpose of evaluating the capacity of the employee to perform the work of his or her position.

G. If an employee refuses to return to work in a position offered by the employer under the State’s Injured State Worker Assistance Program, NDI benefits will be terminated effective the date of the offer.

H. Where employment is intermittent or irregular, the payments shall be determined on the basis of the proportionate part of a monthly rate established by the total hours actually employed in the 18 monthly pay periods immediately preceding the pay period in which the disability begins as compared to the regular rate for a full-time employee in the same group or class. An employee will be eligible for NDI payments on the first day of the monthly pay period following completion of 960 hours of compensated work.

I. All other applicable Department of Personnel Administration laws and regulations not superseded by these provisions will remain in effect.

J. Upon approval of NDI benefits, the State may issue an employee a salary advance if the employee so requests.

K. All appeals of a denial of an employee’s NDI benefits shall only follow the procedures in the Unemployment Insurance Code and Title 22. All disputes relating to an employee’s denial of benefits are not grievable or arbitrable. This does not change either party’s contractual rights which are not related to the denial of an individual’s benefits.

To qualify for NDI an employee must be a current, active member of the Public Employees’ Retirement System (PERS), the State Teachers’ Retirement System (STRS) or a full- or part-time state officer or employee of the Legislature.

An employee must be in compensated employment (in pay status and not separated by a formal leave of absence). All permanent part-time and full-time employees or probationary employees or state officers are covered under the program. Permanent part-time and permanent intermittent employees and state officers who have at least six monthly compensated pay periods of service in the 18 months immediately preceding the pay period in which the disability begins may also be eligible for NDI benefits on a pro-rated basis.

Deductions

Voluntary deductions such as credit union loans, savings accounts, bonds, parking fees, health insurance premiums, etc., will automatically be deducted from the NDI benefits unless canceled by the employee. If health benefits are continued, the state’s employer contribution will also continue.

The IRS has ruled that NDI benefits are taxable wages, and as a result, the controller’s office will withhold state and federal taxes and Social Security contributions.

Medical Examinations

You may be required to submit to an examination or examinations in order to determine your mental or physical disability. Fees for such examinations are paid by the state.

How to Apply for NDI

Obtain a claim form from your local office attendance clerk, department personnel office, or EDD disability insurance field office. Completely fill out only the lower half of the claim statement and have your attendance clerk fill out the upper half. Then give the claim to your doctor for completion of the doctor’s certificate on the reverse side. Your doctor may be any licensed physician, surgeon, osteopath, chiropractor, podiatrist, optometrist, dentist, psychologist, a medical officer of a U.S. medical facility or an accredited religious practitioner.

If you think your rights have been violated with respect to NDI, contact the CASE Office at 1-800-699-6533.

ENDI and NDI-Family Care Leave:

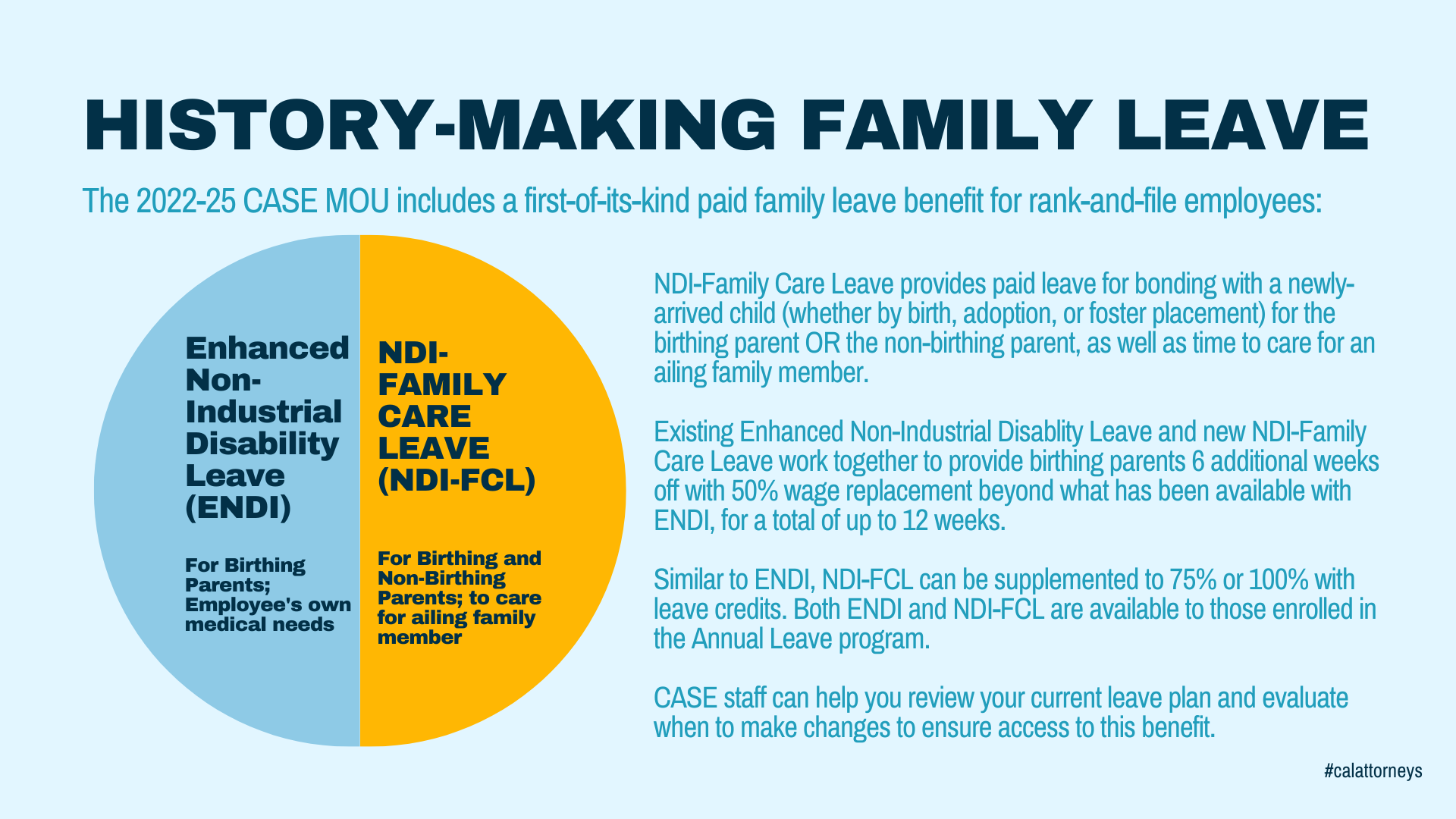

Article 11.7 provides unit 2 employees with Enhanced Non-Industrial Disability Leave (ENDI), a benefit providing partial wage replacement for up to 26 weeks for Unit 2 employees enrolled in the Annual Leave Program. This program applies only to the personal medical needs of the Unit 2 employee and does not cover time needed to care for a loved one or to bond with a newly arrived child.

In 2022, CASE secured a first-of-its kind paid family leave benefit for rank-and-file state employees. Staring January 1, 2023, Unit 2 employees enrolled in the Annual Leave Program can access NDI-Family Care Leave. NDI-FCL provides partial wage replacement for birthing and non-birthing new parents (whether a child arrives by birth, adoption, or foster placement) for up to 6 weeks.

NDI-Family Care Leave fills in the missing piece of paid leave for birthing parents and provides important paid time off to care for family members when they need it most, as well as to bond with children during an important time in their lives.

For Unit 2 employees adding to their families before July 1, 2023: NDI-FCL can be accessed any time during the first year of the child’s life or placement.

You have the option to supplement ENDI or NDI-FCL with available leave benefits up to 75% or 100% of your regular pay. Supplementing to 75% or 100% means your time off still constitutes a qualifying pay period, meaning you keep intact your other state benefits and accrue service credit.